Published: September 2024

Published: September 2024

Introduction

Navigating the tourism investment landscape in Canada can be daunting.

There is a clear need for municipalities and destination marketing organizations (DMOs) to pool resources and develop tourism products and experiences that match the desires of both Canadians and our guests, thereby helping to create a sustainable industry that benefits all parties involved. At the same time, the path to attracting investment is set in stone. Most communities are either new to plotting out their aspirations for destination development or do not have experience in anticipating the expectations of private investors (or both).

This article highlights best practices and tools for Canadian destinations to consider in order to attract sustainable private investment, while integrating their own community goals. This objective matches Destination Canada’s own corporate goal to “help grow a vibrant tourism sector for both leisure travel and business events travel,” and aspiration for tourism to “generate wealth and wellbeing for all of Canada, while enriching the lives of our guests.”

Introduction

Navigating the tourism investment landscape in Canada can be daunting.

There is a clear need for municipalities and destination marketing organizations (DMOs) to pool resources and develop tourism products and experiences that match the desires of both Canadians and our guests, thereby helping to create a sustainable industry that benefits all parties involved. At the same time, the path to attracting investment is set in stone. Most communities are either new to plotting out their aspirations for destination development or do not have experience in anticipating the expectations of private investors (or both).

This article highlights best practices and tools for Canadian destinations to consider in order to attract sustainable private investment, while integrating their own community goals. This objective matches Destination Canada’s own corporate goal to “help grow a vibrant tourism sector for both leisure travel and business events travel,” and aspiration for tourism to “generate wealth and wellbeing for all of Canada, while enriching the lives of our guests.”

The tourism investment landscape in Canada

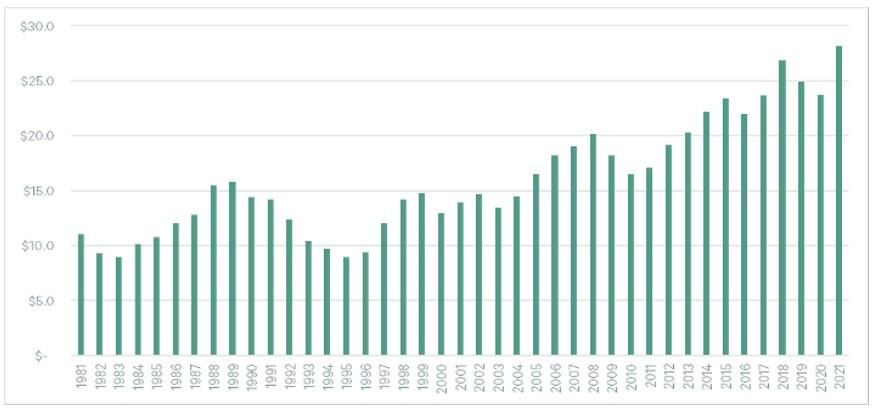

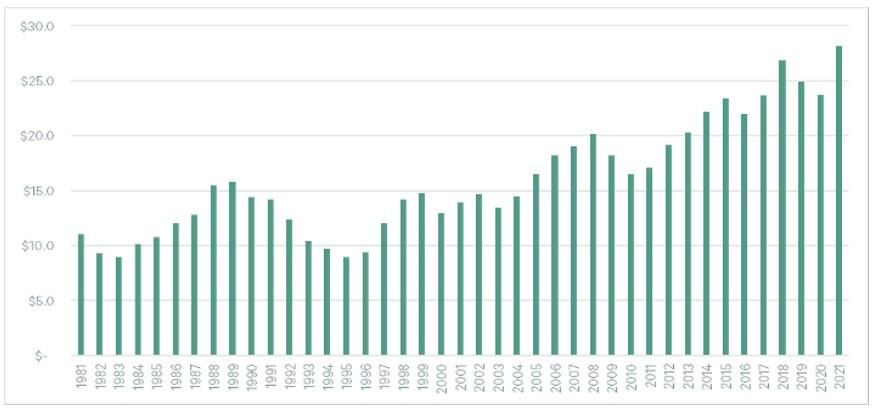

According to Statistics Canada, the share of capital investment by tourism industries1 in Canada has steadily increased from a low of 4.2% in 2011 to a high of 9.9% of all non-residential capital investment in 2021, or $35.0 billion. On average, investment by tourism industries has increased 5.3% annually since 2011.

Source: Statistics Canada, Tourism Investment Module

1 Tourism industries are a subset of all industries in Canada and include those related to transportation, accommodation, food and beverage services, recreation and entertainment, and travel services that are likely to cater directly to tourists (Source: Statistics Canada)

The tourism investment landscape in Canada

According to Statistics Canada, the share of capital investment by tourism industries1 in Canada has steadily increased from a low of 4.2% in 2011 to a high of 9.9% of all non-residential capital investment in 2021, or $35.0 billion. On average, investment by tourism industries has increased 5.3% annually since 2011.

Source: Statistics Canada, Tourism Investment Module

1 Tourism industries are a subset of all industries in Canada and include those related to transportation, accommodation, food and beverage services, recreation and entertainment, and travel services that are likely to cater directly to tourists (Source: Statistics Canada)

In 2021, three industries accounted for 70% of total tourism investment: urban transit systems ($16.8 billion), passenger car rental ($4.0 billion), and scheduled air transportation ($3.7 billion). Approximately 42% of investment by tourism industries originated directly from the private sector in 2021, which is up from a low of 35% in 2020, but down from a high of 75% in 1987. Much of the shift has come with an increase in government investment, loss of business confidence during COVID, and recent inflationary factors. However, the private investment share is expected to increase again once inflation and the high cost of financing subsides.

Large-scale tourism investments in Canada are often developed as part of a public-private partnership, or a “P3,” project. A P3 involves a “creative alliance” between public and private sector entities to fulfill a long term-goal, typically for projects that lead to the sustainable development of an area or region. These projects are usually championed by the public sector that require large investments, which in turn lever private sector involvement. In a P3 model, private financing can be a source of revenue and support increased infrastructure investment without immediately adding to government borrowing and debt. P3s present business opportunities to the private sector in areas where in many cases these companies were previously excluded. Furthermore, larger budgets and the ability to use their own methodologies can incentivize the private sector to deliver projects on time and on budget.

P3 projects that require massive investments for the benefit of both tourists and residents include:

- Real estate-based projects, e.g., mixed-use commercial developments

- Urban revitalization projects

- Public facilities, e.g., convention centres or event venues

While local private sector businesses may be involved in public construction phases, more significant private investment occurs once the public sector has initiated the planning, design, and construction process in larger projects. Projects that are private sector driven are also very important to destination development, but often are not incorporated into broader regional or provincial strategies at the government level. At the destination level, keeping track of private sector tourism projects and learning how they can benefit the community is a good opportunity for the local DMO and can help with investment attraction planning.

Preparing a destination for private investment

There are a variety of things a DMO and/or municipality and its partners can do to prepare for new development and attract investment from the private sector. It should be noted that as DMOs are both expanding their mandates and changing how they prioritize their mandates, the importance of integrating tourism and economic development has become front and centre. Pooling DMO with municipal resources can help to build further collaboration between community building and tourism.

Many organizations choose to undertake Tourism Gap Analysis studies or Tourism Investment Attraction Plans to identify what type of new investment best fits to grow their destinations. This process involves developing inventories of existing tourism assets in the destination, defining assets as “products” (e.g., hotel, event venue, etc.) and “experiences” (e.g., culinary, nature & outdoors, etc.). At this stage, gathering stakeholder input on what opportunities they have envisioned is key.

Evaluating a long list of potential tourism projects based on their private investment potential, market and economic feasibility, and appeal for the local residents, is a good way to determine what might work in a destination before seeking investment. Upon evaluation, pre-feasibility studies may be undertaken, so that the destination partners truly understand the market demand and economic potential of a tourism project before presenting an investment opportunity to a developer.

An organization can also prepare Tourism Investment Opportunity Packages for developers, highlighting projects that have highest potential for market and economic support in the short term. The following is a list of what might be included in an Investment Package:

Return expectation for destinations

Return expectation for destinations

The ability to attract private sector developers to a community is typically contingent on the ability to demonstrate sufficient investor returns to the developer, while ensuring community needs are met.

Traditional large-scale private investors tend to look for sites in stable business environments with strong visitor demand and well-developed infrastructure (e.g., highways and air access). Increasingly, however, developers are looking to invest in destinations that feature more unique experiences, adapt sustainable tourism practices, and foster collaboration with government agencies and DMO.

Return on Investment (ROI) expectations for private developers in the tourism sector tend to average around 20% by the stabilized year of operation, but this can be diminished if land acquisition is involved. Typically, investors prefer land sales to land leases and often look to the municipality to provide some levels of incentive, if possible.

This is not necessarily the case with Indigenous communities, where tourism-related investment often occurs on leased land or more recently on “urban reserves.” It is our understanding that many First Nations communities are reclaiming sites within municipal limits as urban reserves with independent jurisdiction, wherein mixed-used developments can both support communities through economic prosperity and drive new visitation.

In both Indigenous and non-Indigenous communities, municipalities can assist in reducing costs for developers by one of the following options:

- Providing the land to the developer at no cost

- Offering property tax abatements during the first few years of operation

- Waiving development charges

Finally, it is essential for destinations to consider what they want in return from a developer and to consider the impact of specific tourism investments on people, place, and prosperity. For example, asking the following questions:

- Does this tourism business reflect the community’s values?

- What will the business do to become embedded in the community?

- Will the business provide well-paying jobs and an inclusive environment for staff and customers?

- Will the business commit to the destination’s sustainability efforts, e.g., sourcing renewable energy where possible?

- Does the business support adaptive reuse of existing infrastructure (where possible, as opposed to demolishing buildings) – or integrate sustainable architecture?

Setting targets based on a regenerative tourism approach is a clear way for a DMO to ensure a tourism investment will be a good fit for the community. Destination Canada’s publication on A Regenerative Approach to Tourism in Canada is an excellent resource for determining how to integrate this approach.